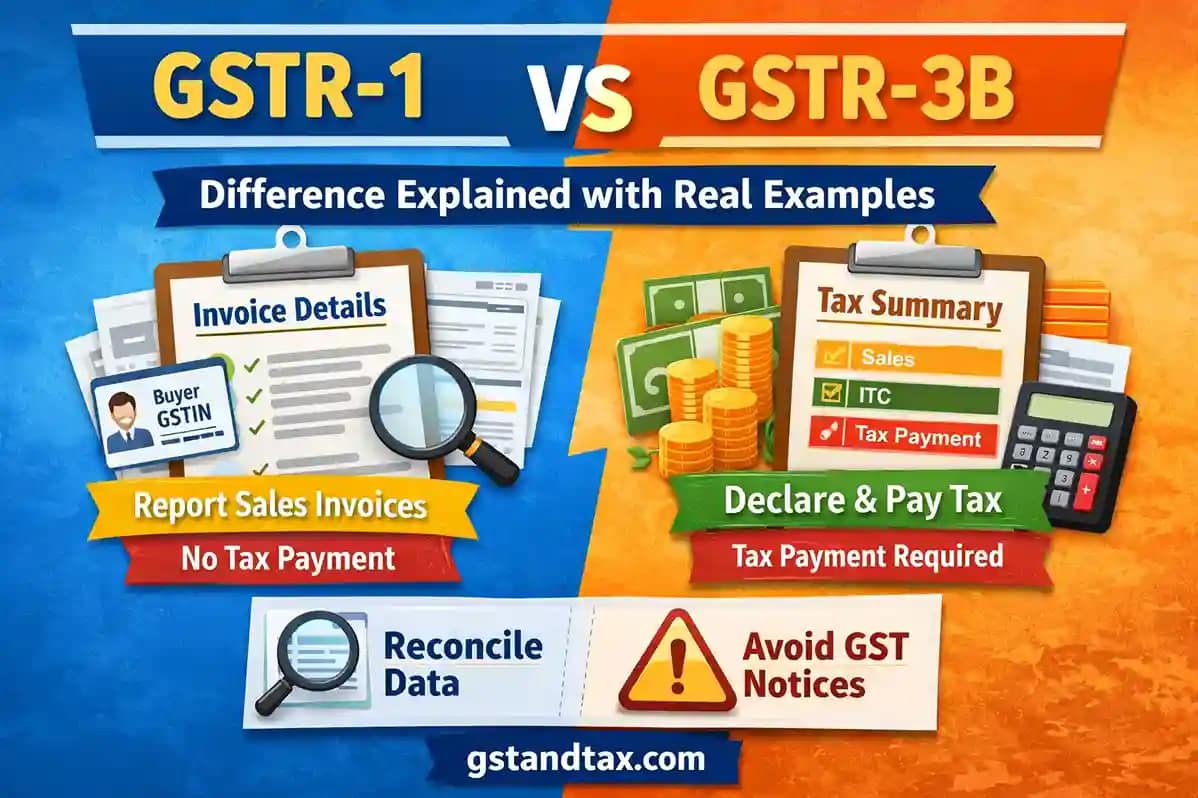

GSTR-1 vs GSTR-3B difference is one of the most common areas of confusion among GST taxpayers in India.

GSTR-1 vs GSTR-3B difference is one of the most common areas of confusion among GST taxpayers in India. A large number of GST-registered taxpayers, especially small businesses and first-time filers, struggle to understand why they have to file two separate returns for sales and tax payment. This confusion often leads to reporting mistakes, mismatches, and eventually GST notices.

Although both returns are interconnected, GSTR-1 and GSTR-3B serve completely different purposes. Understanding the difference between them is not just important for compliance—it is essential to avoid penalties, interest, and unnecessary scrutiny from the GST department.

In this guide, we explain the difference between GSTR-1 and GSTR-3B in simple language, supported by real-world examples, tables, and practical tips.

Many GST notices arise due to misunderstanding the difference between GSTR-1 and GSTR-3B, making reconciliation more important than ever.

GSTR-1 vs GSTR-3B Difference Explained Simply

Understanding the Basic Difference (In Simple Words)

Before going into technical details, remember this golden rule:

GSTR-1 tells the government what you sold

GSTR-3B tells the government how much tax you owe and pay

Both returns must reflect the same sales value, but they are reported in different formats and for different purposes.

Understanding the GSTR-1 vs GSTR-3B difference helps taxpayers avoid return mismatches, GST notices, and unnecessary penalties.

What Is GSTR-1? (Detailed Sales Reporting Return)

GSTR-1 is a statement of outward supplies (sales) made during a tax period. It captures invoice-level details, which are crucial for determining the Input Tax Credit (ITC) eligibility of your customers.

What information is reported in GSTR-1?

B2B invoices with GSTIN-wise details

Large B2C invoices (above threshold)

Consolidated B2C sales

Export and zero-rated supplies

Debit notes and credit notes

Important point:

No tax payment is made while filing GSTR-1. It is only a reporting return, not a tax payment return.

What Is GSTR-3B? (Summary Tax Return)

GSTR-3B is a summary self-assessment return. It is used to declare:

Total outward supplies

Total inward supplies

Eligible ITC

Net GST liability

Tax payment details

Key difference:

Tax payment is mandatory in GSTR-3B. If there is any error here, it directly results in short payment of tax, which attracts interest and penalties.

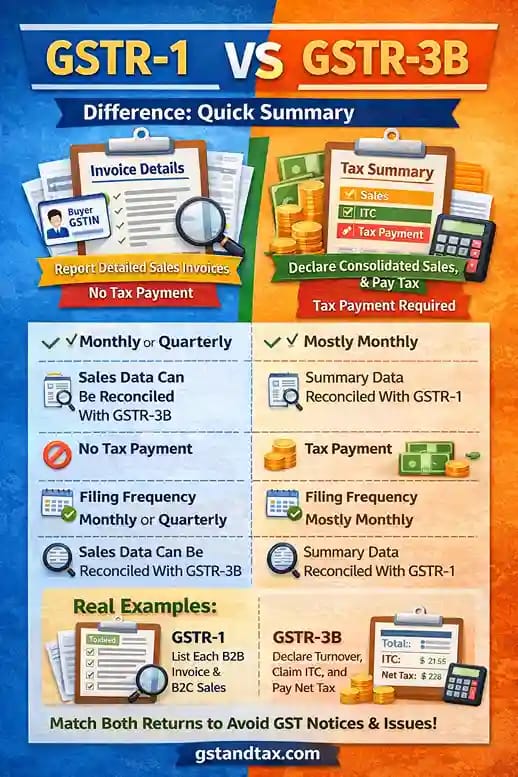

Key Differences Between GSTR-1 and GSTR-3B (Comparison Table)

| Aspect | GSTR-1 | GSTR-3B |

|---|---|---|

| Main Purpose | Detailed reporting of sales | Declaration & payment of GST |

| Nature of Return | Statement return | Self-assessment return |

| Level of Detail | Invoice-wise details | Consolidated summary |

| Tax Payment | Not required | Mandatory |

| Impact on ITC | Enables buyer to claim ITC | Determines ITC actually claimed |

| Filing Frequency | Monthly / Quarterly | Mostly Monthly |

| Risk of GST Notice | Indirect (buyer ITC issues) | Direct (tax demand) |

This table clearly highlights the difference between GSTR-1 and GSTR-3B, making it easier to understand their individual roles.

Real-Life Example to Understand GSTR-1 vs GSTR-3B

Example 1: How Sales Are Reported in GSTR-1

Rina owns a trading business.

During April:

She sells goods worth ₹6,00,000 to registered dealers (B2B)

She sells goods worth ₹2,00,000 to retail customers (B2C)

In GSTR-1, Rina:

Reports each B2B invoice separately with GSTIN, invoice number, and tax amount

Reports B2C sales as a consolidated figure

This detailed reporting allows her B2B customers to see invoices in their records and claim ITC.

Example 2: How Tax Is Declared and Paid in GSTR-3B

For the same month, Rina:

Calculates GST collected on total sales

Checks eligible ITC from purchase invoices

Pays the net GST liability

In GSTR-3B, she reports:

Total outward supplies (₹8,00,000)

Total ITC claimed

Net tax payable in cash

This example clearly shows that GSTR-1 and GSTR-3B are not interchangeable, even though they deal with the same transactions.

Why Reconciliation Between GSTR-1 and GSTR-3B Is Crucial

In today’s GST system, data matching is automated. Any mismatch between GSTR-1 and GSTR-3B is instantly flagged by the system.

Common mismatch situations:

Sales reported in GSTR-1 but not declared in GSTR-3B

Excess ITC claimed in GSTR-3B

Late amendments not reflected correctly

Such mismatches often result in system-generated GST notices.

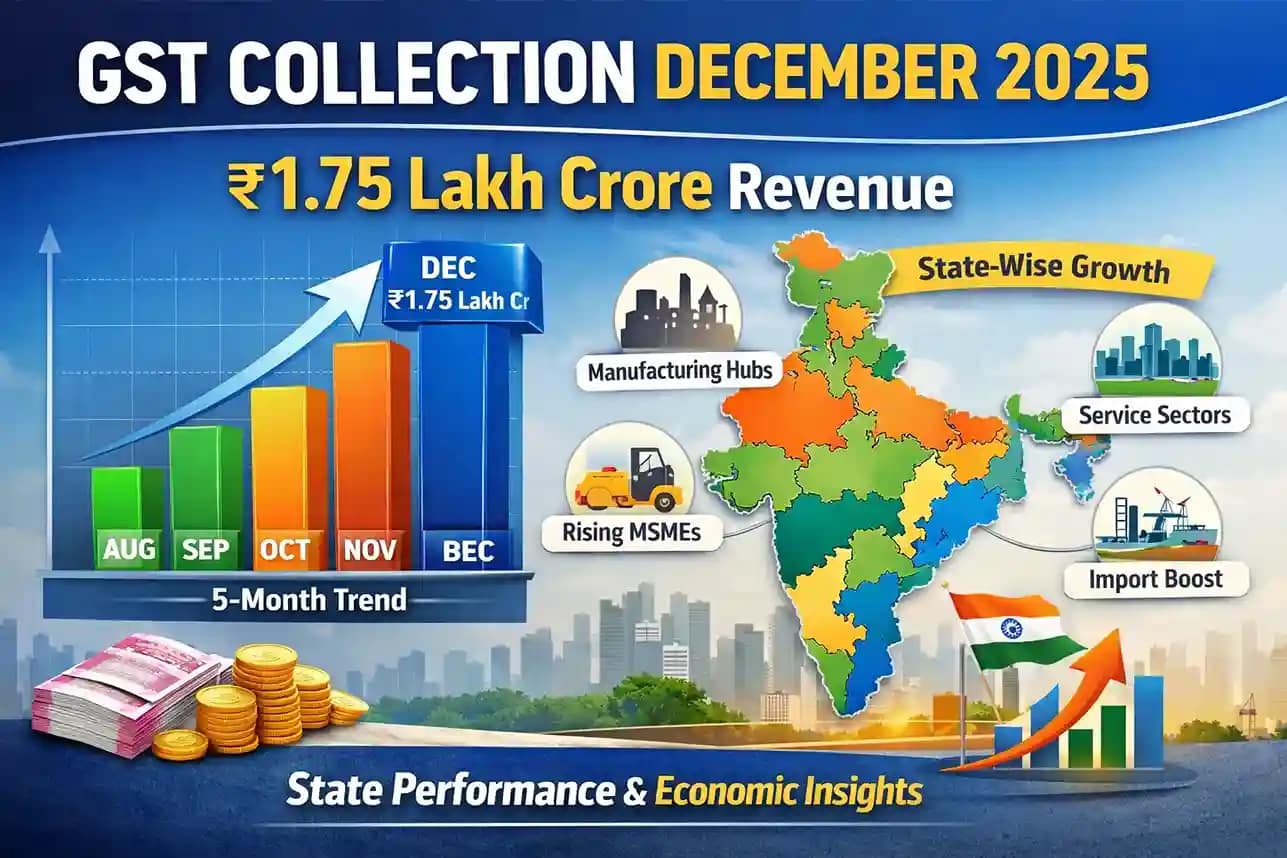

Also Read:-https://gstandtax.com/gst-collection-december-2025-state-wise-trend/

Consequences of GSTR-1 vs GSTR-3B Mismatch

| Issue | Possible Outcome |

|---|---|

| Higher turnover in GSTR-1 | GST demand notice |

| Excess ITC in GSTR-3B | ITC reversal + interest |

| Delayed corrections | Penalty risk |

| Buyer ITC mismatch | Business relationship issues |

Common Mistakes Taxpayers Make

Many taxpayers assume:

GSTR-1 is “less important” because no tax is paid

Small differences will be ignored

In reality:

GSTR-1 errors affect customer ITC

GSTR-3B errors affect your tax liability

Both returns must be treated with equal seriousness.

Best Practices to Avoid Problems

To stay compliant and avoid GST notices:

Reconcile GSTR-1 and GSTR-3B every month

Ensure sales figures match exactly

Correct errors in GSTR-1 before filing GSTR-3B

File returns on time to avoid late fees

Maintain proper invoice records

Final Conclusion

If you are confused between GSTR-1 and GSTR-3B, remember this simple explanation:

GSTR-1 shows what you sold

GSTR-3B shows what tax you pay

Both returns must reflect the same reality, only in different formats. Regular reconciliation, correct reporting, and timely filing will help you avoid GST notices and maintain smooth compliance. Once the GSTR-1 vs GSTR-3B difference is clear, GST compliance becomes easier and error-free.

1 thought on “Confused Between GSTR-1 and GSTR-3B? Differences Explained with Real Examples”