Cash Withdrawal Limit from Bank in India Without Tax – ATM Rules, Charges & Income Tax Explained

Many people in India still prefer cash for business, family needs, agriculture, or personal expenses. Yet a common fear remains: “How much cash can I withdraw from the bank without tax?”

Some people believe withdrawing a large amount of cash is illegal, while others worry that it may automatically lead to an income tax notice.

As a tax professional, I often see people worried that withdrawing their own money may cause trouble, which is not always true.

The reality is simple: cash withdrawal is legal, but certain rules, limits, and reporting requirements apply.

In this article, we explain the cash withdrawal limit from bank in India without tax, ATM rules, bank charges, and income tax provisions under Section 194N, in a clear and practical way.

Is There Any Legal Limit on Cash Withdrawal from Bank?

There is no maximum legal cap on withdrawing cash from your own bank account in India. You are free to withdraw your money whenever you need it.

However, the confusion starts because:

-

Banks have operational limits

-

Income tax law has TDS and reporting rules

-

High cash usage attracts scrutiny

So when people talk about a “safe limit,” they usually mean:

-

No TDS deduction

-

No income tax questioning

-

Smooth banking experience

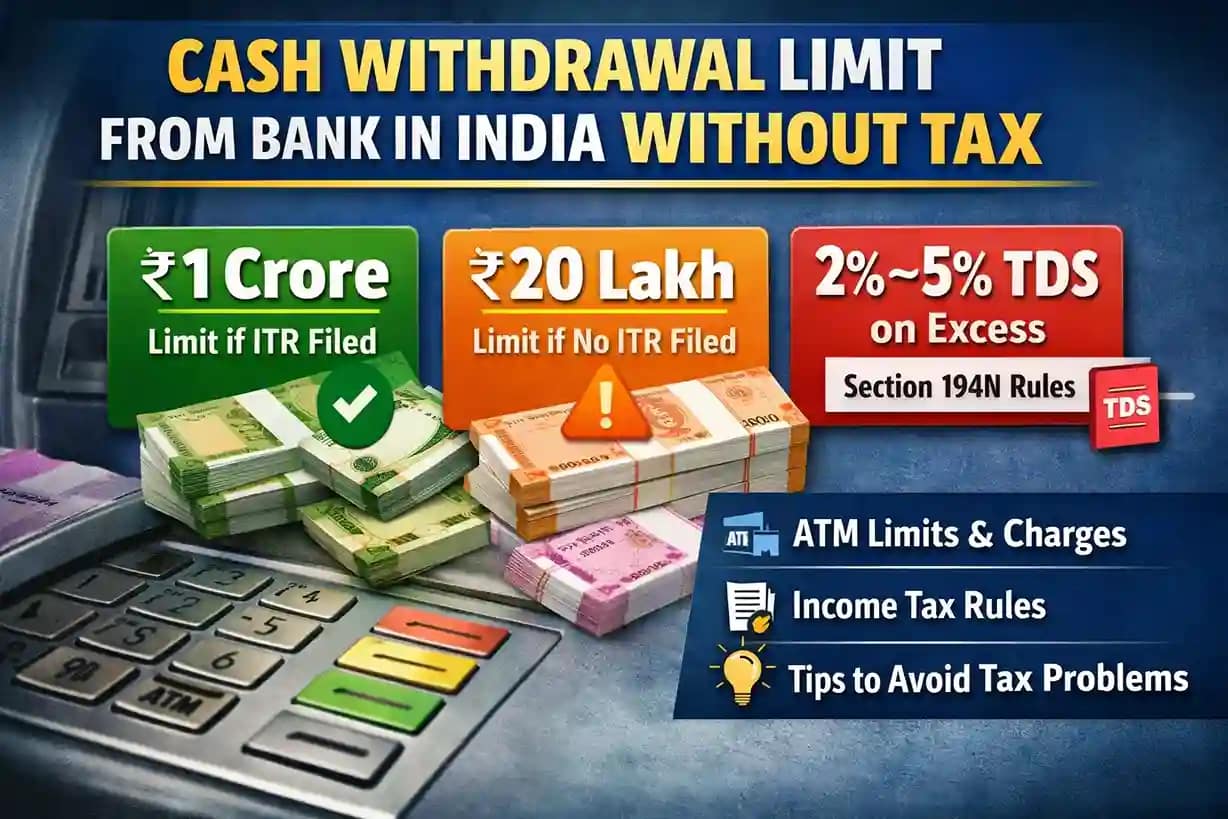

Income Tax Rules on Cash Withdrawal – Section 194N Explained

The most important law governing cash withdrawal is Section 194N of the Income Tax Act.

Under this section, TDS (Tax Deducted at Source) is applicable if cash withdrawal during a financial year exceeds a specified limit. These rules are implemented and monitored by the Income Tax Department.

Cash Withdrawal Limit Without TDS (Most Important Table)

Your ITR filing history decides how much cash you can withdraw without tax.

Cash Withdrawal Limits Without TDS

| ITR Filing Status (Last 3 AYs) | Annual Cash Withdrawal Limit |

|---|---|

| ITR filed (any or all 3 years) | Up to ₹1 Crore |

| ITR not filed for all 3 years | Up to ₹20 Lakh |

This provision applies under Section 194N and is one of the most misunderstood income tax rules.

TDS Rates After Crossing the Limit

TDS is deducted only on the amount exceeding the threshold, not on the entire withdrawal.

| Category | Withdrawal Amount | TDS Rate |

|---|---|---|

| ITR filers | Above ₹1 Crore | 2% |

| Non-ITR filers | ₹20L – ₹1Cr | 2% |

| Non-ITR filers | Above ₹1Cr | 5% |

| PAN not provided | Above ₹20L | 20% |

Practical Examples for Better Understanding

Example 1: Regular ITR Filer

Mr. A files his income tax return every year and withdraws ₹90 lakh in cash during the year.

No TDS deducted

Fully compliant transaction

Example 2: Withdrawal Above ₹1 Crore

Total cash withdrawn = ₹1.20 crore

Excess amount = ₹20 lakh

TDS @2% = ₹40,000

Only the excess portion is taxed.

Example 3: Non-ITR Filer

Cash withdrawn = ₹50 lakh

₹20 lakh – No TDS

₹30 lakh – TDS @2% = ₹60,000

Also Read:-https://gstandtax.com/itr-fy-2024-25-know-which-form-you-need-to-file/

Is the Limit Per Bank or Per PAN?

The limit applies to the aggregate cash withdrawals from all accounts maintained with a single bank or post office during a financial year.

If you maintain accounts in different banks, the limit applies separately to each bank, although PAN-based reporting still enables tracking.

Is TDS on Cash Withdrawal Final Tax?

No. TDS deducted under Section 194N is not a permanent tax.

You can:

-

Claim a refund, or

-

Adjust it against your total tax liability while filing ITR

This means the deduction is mainly a monitoring tool, not a penalty.

Why Section 194N Was Introduced

The government introduced this rule to:

-

Reduce heavy cash transactions

-

Encourage digital payments

-

Track unaccounted money

-

Improve financial transparency

Who Is Exempt from TDS Under Section 194N?

TDS does not apply to withdrawals by:

-

Central or State Government

-

Banks and cooperative banks

-

Post Offices

-

Business correspondents

-

White-label ATM operators

-

APMC-notified agents paying farmers

-

RBI-licensed money changers

-

Other persons notified by the Government

From When Is Section 194N Applicable?

Section 194N is applicable from 1 September 2019 and continues to apply for all subsequent financial years.

ATM Cash Withdrawal Rules in India (2026)

ATM withdrawal limits are governed by banks under guidelines issued by the Reserve Bank of India.

Daily ATM Withdrawal Limits

| Card Type | Daily Limit |

|---|---|

| Basic / Classic Cards | ₹20,000 – ₹40,000 |

| Premium / Platinum Cards | ₹50,000 – ₹1,00,000+ |

| Current Account Cards | Higher limits |

Limits vary based on bank and card category.

Free ATM Transactions and Charges

Free Transactions Per Month

| ATM Type | Free Transactions |

|---|---|

| Own bank ATM | As per bank policy |

| Other bank ATM (Metro) | 3 |

| Other bank ATM (Non-metro) | 5 |

After free usage:

-

₹23 per transaction + GST

-

International ATM withdrawals attract higher charges

Bank Branch Cash Withdrawal Rules

-

Normal savings account withdrawals are generally free

-

Bulk withdrawals may require prior intimation

-

Current accounts offer higher flexibility

-

Non-KYC accounts may face restrictions

Does Bank Inform Income Tax About Cash Withdrawal?

Yes. Banks report high-value cash transactions through Statement of Financial Transactions (SFT).

Cash withdrawals of ₹1 crore or more in a financial year are reported to the Income Tax Department.

Reporting does not automatically mean a notice.

When Can Cash Withdrawal Trigger an Income Tax Notice?

A notice may arise if:

-

Cash withdrawals are high but income shown is low

-

ITR is not filed

-

Business records do not justify cash flow

In real practice, most notices arise not because of withdrawal, but because records are not maintained properly.

Is Cash Withdrawal Taxable Income?

No. Cash withdrawal is not income.

However, you must be able to explain the source if asked.

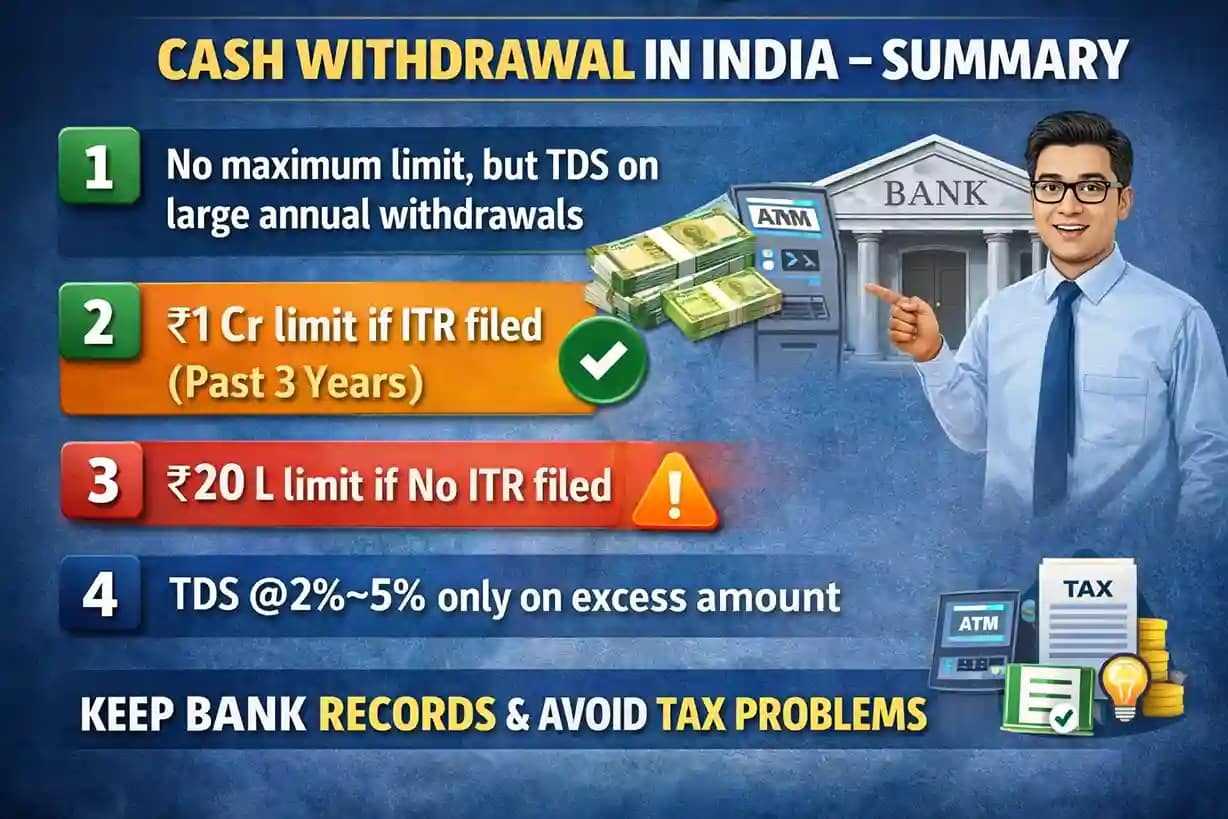

Best Practices to Stay Fully Compliant

-

File ITR every year

-

Avoid unnecessary cash usage

-

Maintain proper records

-

Prefer digital payments for large amounts

-

Do not attempt to split transactions to bypass rules

Final Takeaway

There is no ban on cash withdrawal in India.

If you file ITR regularly, you can withdraw up to ₹1 crore in cash without TDS. ATM and bank limits are operational, while income tax rules focus on transparency.

If you are unsure, always consult your bank or tax advisor before making large cash withdrawals.

Disclaimer: This article is for informational purposes only and should not be considered professional tax advice.

1 thought on “Cash Withdrawal Limit from Bank in India Without Tax – ATM Rules, Charges & Income Tax Explained”