Which ITR Form Should You File for AY 2026-27? Complete Guide for Salaried and Business

Filing an Income Tax Return is a routine task for many taxpayers, but choosing the correct ITR form remains a major source of confusion every year. A large number of returns are delayed, revised, or even marked defective simply because the wrong ITR form is selected.

This leads many taxpayers to ask a very common question.

Which ITR form should I file for AY 2026-27?

In my practical experience of handling income tax related queries, I have noticed that most taxpayers do not make mistakes intentionally. The confusion usually arises because income sources change every year, but people continue filing the same ITR form they used last year.

Many taxpayers ask, which itr form should i file for ay 2026-27, especially when their income sources change.

Why Choosing the Correct ITR Form Matters

Selecting the correct ITR form is not just a formality. In real cases, many taxpayers realise the mistake only when their return is marked defective or when a refund gets stuck. Once that happens, correcting the error takes more time and effort than filing the return correctly in the first place.

Filing the wrong ITR form can result in the following issues.

-

Return treated as defective under section 139(9)

-

Refund delay

-

Income tax notice

-

Need to file a revised return

This is why understanding ITR form selection for AY 2026-27 is extremely important.

List of ITR Forms for AY 2026-27

Below is a simple overview of the commonly used ITR forms.

| ITR Form | Who Should File |

|---|---|

| ITR-1 | Salaried individuals with simple income |

| ITR-2 | Individuals with capital gains |

| ITR-3 | Business or professional income |

| ITR-4 | Presumptive income |

| ITR-5 | Firms and LLPs |

| ITR-6 | Companies |

| ITR-7 | Trusts and institutions |

Most individual taxpayers fall under ITR-1, ITR-2, ITR-3, or ITR-4. This article focuses mainly on these forms.

ITR Form Guide for Salaried Employees

Which ITR Form for Salary Income

Salaried employees usually file either ITR-1 or ITR-2 depending on whether they have income other than salary.

ITR-1 Sahaj

You should file ITR-1 if:

-

You are a resident individual

-

Total income does not exceed fifty lakh rupees

-

Income is from salary or pension

-

Income is from one house property

-

Income from other sources such as bank interest

You cannot file ITR-1 if:

-

You have capital gains

-

You have foreign income or foreign assets

-

You earn income from business or freelancing

This directly answers the question which ITR form for salary income.

ITR-2 for Salaried Employees with Capital Gains

You should file ITR-2 if:

-

You are salaried and

-

You have capital gains from shares, mutual funds, or property

-

You own more than one house property

This is the reason many investors search for ITR form for capital gains.

ITR Forms Explained in Simple Terms with Examples

Let us understand ITR form selection with real life situations.

Example 1 Salaried Employee with Only Salary Income

Income details:

-

Salary income only

-

No capital gains

-

No business income

Correct ITR form is ITR-1.

Example 2 Salaried Employee with Share Market Gains

Income details:

-

Salary income

-

Capital gains from shares or mutual funds

Correct ITR form is ITR-2.

Filing ITR-1 in this case would be incorrect.

ITR Form Guide for Business Owners and Freelancers

Which ITR Form for Business Income

Taxpayers earning income from business or profession generally file either ITR-3 or ITR-4.

ITR-3 for Business or Professional Income

You should file ITR-3 if:

-

You run a business

-

You are a professional such as a consultant, doctor, or chartered accountant

-

You maintain books of accounts

This answers the question which ITR form for business income.

ITR-4 for Presumptive Income

You should file ITR-4 if:

-

You opt for presumptive taxation under section 44AD or 44ADA

-

You do not maintain detailed books of accounts

This form is widely used by freelancers, which explains the growing search for ITR form for freelance income.

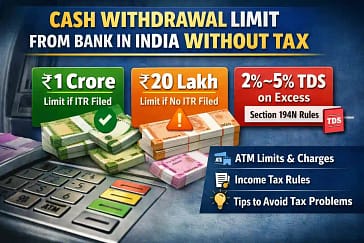

Also Read :-https://gstandtax.com/cash-withdrawal-limit-from-bank-in-india-without-tax/

ITR 1 vs ITR 2 vs ITR 3 Difference

This is the comparison that most taxpayers look for when they are stuck between multiple ITR forms.

| Particulars | ITR-1 | ITR-2 | ITR-3 |

|---|---|---|---|

| Salary income | Yes | Yes | Yes |

| Capital gains | No | Yes | Yes |

| Business income | No | No | Yes |

| Freelance income | No | No | Yes |

| More than one house property | No | Yes | Yes |

This table clearly explains the difference between ITR-1, ITR-2, and ITR-3.

ITR Form for Rental Income

-

Salary with one house property requires ITR-1

-

Salary with more than one house property requires ITR-2

-

Rental income along with business income requires ITR-3

Therefore, the correct ITR form for rental income depends on your overall income profile.

Which ITR Form Should I File for AY 2026-27

You can use this simple logic.

-

Only salary income means ITR-1

-

Salary plus capital gains means ITR-2

-

Business or professional income means ITR-3

-

Presumptive income means ITR-4

This logic helps answer the main question which ITR form should I file for AY 2026-27.

Common Mistakes While Selecting ITR Form

Many taxpayers repeat the same mistakes every year.

-

Filing ITR-1 despite having capital gains

-

Freelancers using ITR-1 instead of ITR-3

-

Ignoring rental income

-

Using the previous year ITR form without reviewing income changes

In most cases, a wrong ITR form is not a tax evasion issue, but simply a lack of correct information.

Frequently Asked Questions

Which ITR form should salaried employees file

Salaried employees should file ITR-1 or ITR-2 depending on whether they have capital gains.

Can I file ITR-1 if I have capital gains

No. In such cases, ITR-2 is required.

Which ITR form is used for business income

ITR-3 or ITR-4 depending on whether presumptive taxation is chosen.

What happens if wrong ITR form is filed

The return may be marked defective or rejected.

Final Conclusion

Choosing the correct ITR form is just as important as filing the return itself. Selecting the wrong form can lead to notices, refund delays, and unnecessary stress.

Always review your income sources carefully and use this ITR form guide for AY 2026-27 before filing your return. When in doubt, it is always better to verify the form instead of guessing.

Correct ITR form selection ensures smooth filing, timely refunds, and peace of mind